The Grasset Nickel Deposit

Grasset Nickel-Copper-Cobalt-Platinum-Palladium Deposit

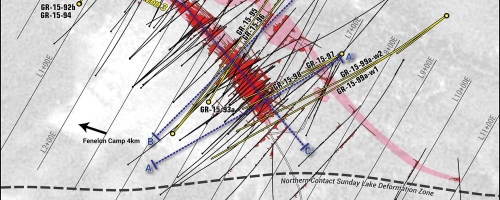

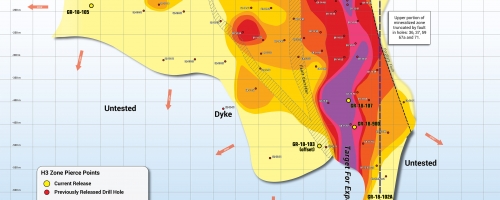

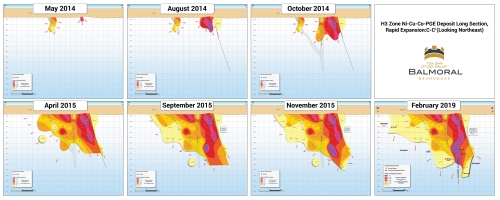

The Grasset Ni-Cu-Co-Pt-Pd deposit occurs at the southern end of the Grasset Ultramafic Complex (“GUC”), immediately north of the regional Sunday Lake Fault System. The deposit is comprised of two subparallel zones of disseminated to locally semi-massive sulphide mineralization, the H1 and H3 Zones. The H1 and H3 Zones are typically separated by 50 to 80 metres of barren to weakly mineralized ultramafic rock. Both zones are near vertically dipping. The H3 Zone extends for 500 metres along strike and to vertical depths of 550 vertical metres, below which it remains open for potential expansion. The less extensively H1 Zone has been intersected for over 1,000 metres along strike and to a vertical depth of approximately 450 metres. It remains open along strike to the northwest and to depth.

Initial Resource Estimate

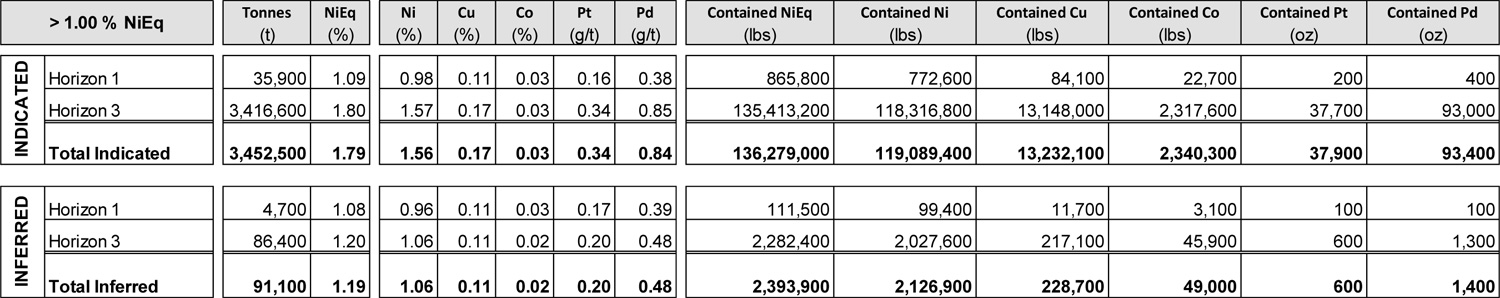

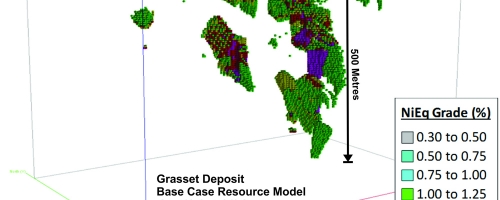

In March of 2016 Balmoral published the initial resource estimate for the Grasset Deposit. The Base Case Resource Estimate for the Grasset Deposit is:

The Base Case Resource Estimate, based on a series assumptions and cost estimates as detailed below was prepared by Independent Qualified Persons Mr. Pierre-Luc Richard (M.Sc., P.Geo.) and Mr. Carl Pelletier (B.Sc., P.Geo.) of InnovExplo Inc. in Val d’Or, Quebec. The Base Case Estimate is focussed on the higher-grade core of the deposit with 99% of the estimated resource contained within the high-grade core of the H3 Zone. Drill density is close enough to provide sufficient confidence to place 97.5% of the estimate resource into the indicated category. The Base Case estimate is set at a Nickel Equivalent (see note 7 below) cut-off grade of 1% Nickel.

Surrounding the high-grade core on which the initial resource estimate is based is a larger volume of disseminated nickel-sulphide mineralization which also remains open for expansion and which could potentially be brought into the resource model through changes in metal prices, exchange ratios, mining, milling, transport and smelting costs and improvements in the metallurgical assumptions contained within the initial resource model.

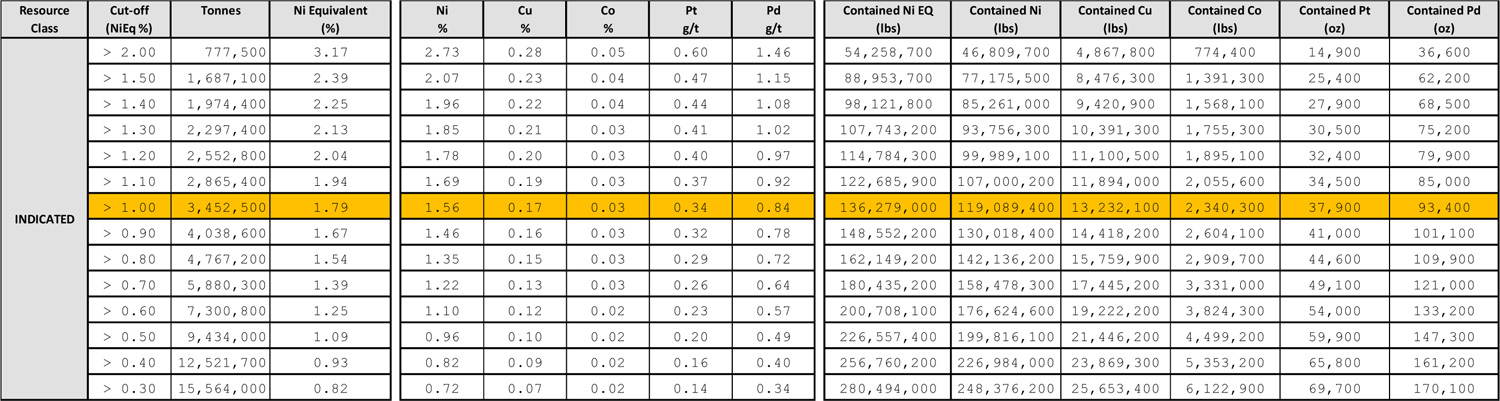

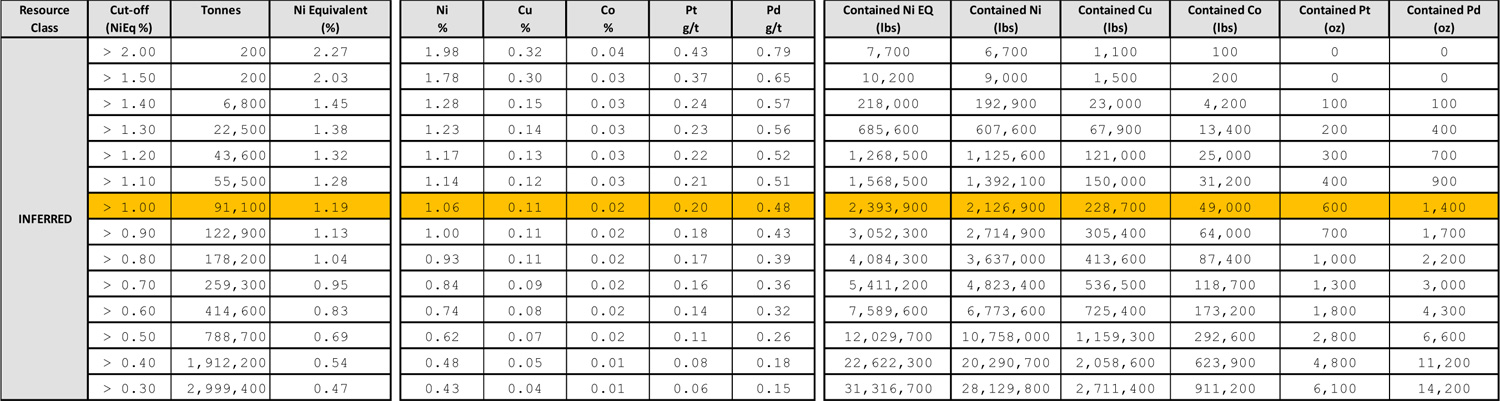

The two tables below exhibit the volumetric calculations for the combined H1 and H3 zones at a range of cut-off grades as calculated by Mr. Richard and Mr. Pelletier in conjunction with the initial resource estimate. Listed below the tables are the assumptions and basis for the calculations involved with the production of the initial resource estimate

Table 2a: Indicated Resource at Range of Cut-Off Values

Table 2b: Inferred Resource at Range of Cut-Off Values

Resource Estimate Assumptions and Notes:

- The Independent and Qualified Persons for the Mineral Resource Estimate, as defined by NI 43‑101, are Mr. Pierre-Luc Richard, P.Geo., M.Sc., and Mr. Carl Pelletier, P.Geo., B.Sc., both of InnovExplo Inc. The effective date of the Estimate is January 12, 2016

- These mineral resources are not mineral reserves as they do not have demonstrated economic viability.

- While the results are presented undiluted and in situ, the reported mineral resources are considered to have reasonable prospects for eventual economic extraction.

- The estimate includes two (2) mineralized zones (Horizon 1 and Horizon 3).

- Resources were compiled at NiEq cut-off grades of 0.30%, 0.40%, 0.50%, 0.60%, 0.70%, 0.80%, 0.90%, 1.00%, 1.10%, 1.20%, 1.30%, 1.40%, 1.50%, and 2.00%. The base case resource potential is reported at a 1.00% NiEq cut-off grade.

- Cut-off calculations used: CAD 48.00$ Mining, 6.00$ Maintenance, 10.00$ G&A;, 22.00$ Milling for a total of 86.00$ operating costs. A dilution factor of 7.5% was also applied to the cut-off grade calculation.

- *NiEq = [[(NiGrade(%) x NiCR(%) x NiPayable(%) x NiPrice($)) + (CuGrade(%) x CuCR(%) x CuPayable(%) x CuPrice($)) + (CoGrade(%) x CoCR(%) x CoPayable(%) x CoPrice($))] x 2205 + [(PtGrade(g/t) x PtCR(%) x PtPayable(%) x PtPrice($)) + (PdGrade(g/t) x PdCR(%) x PdPayable(%) x PdPrice($))] / 31.1035 - CrPenalty($)] / (NiPayable(%) x NiCR(%) x NiPrice($) x 2205); where CR(%) is a variable concentrate recovery ratio derived from metallurgical balance study, and Payable(%) is applied on concentrates. Note that a minimum deduction of 0.20% Co was applied on concentrate.

- NiEq calculations used: USD/CAD exchange rate of 1.14, Nickel price of US$6.56/lbs, Copper price of US$2.97/lbs, Cobalt price of US$13.00/lbs, Platinum price of US$1,302.30/oz, and Palladium price of US$737.20/oz (These are 3-year trailing averages calculated at the effective date); Payable of 70% for Nickel, 75% for Copper, 75% for Cobalt (minimum deduction of 0.20%), 45% for Platinum, and 45% for Palladium applied on expected concentrate based on analysis of available smelting and refining cost parameters

- Cut-off and NiEq calculations would have to be re-evaluated in light of future prevailing market conditions (metal prices, exchange rate, smelting terms, and mining costs).

- Density values were estimated for all lithological units from measured samples. Density values for the Horizon 1 and Horizon 3 mineralized zones were interpolated from both a measured density database and a correlation database accounting for a selection of metals (Ni, Fe, Co) yielding the best correlation with the measured database.

- The resource was estimated using GEMS 6.7. The estimate is based on 111 diamond drill holes (39,999.43 m). A minimum true thickness of 3.0 m was applied, using the grade of the adjacent material when assayed, or a value of zero when not assayed.

- High grade capping was done on raw assay data and established on a per zone basis for Nickel (15.00%), Copper (5.00%), Platinum (5.00g/t), and Palladium (8.00g/t). Capping grade selection is supported by statistical analysis.

- Compositing was done on drill hole sections falling within the mineralized zones (composite = 1.0 m).

- Resources were evaluated from drill holes using a 3-pass ID2 interpolation method in a block model (block size = 5 x 5 x 5 m).

- The Mineral Resources presented herein are categorized as Indicated and Inferred based on drill spacing, geological and grade continuity. Based on the nature of the mineralization, a maximum distance to the closest composite of 50 m was used for indicated Resources. The average distance to the nearest composite is 22.9 m for the Indicated resources and 53.6 m for the Inferred resources.

- Ounce (troy) = metric tonnes x grade / 31.10348. Calculations used metric units (metres, tonnes and g/t). Metal contents are presented in ounces and pounds.

- The number of metric tons was rounded to the nearest hundred. Any discrepancies in the totals are due to rounding effects

- The quantity and grade of reported Inferred resources in this Mineral Resource Estimate are uncertain in nature and there has been insufficient exploration to define these Inferred resources as Indicated or Measured, and it is uncertain if further exploration will result in upgrading them to these categories.

- CIM definitions and guidelines for mineral resources have been followed.

- The Qualified Persons are not aware of any known environmental, permitting, legal, title-related, taxation, socio-political or marketing issues, or any other relevant issue, that could materially affect the Mineral Resource Estimate.

As indicated above the Grasset Deposit is comprised of two zones of mineralization. The H3 zone occurs as a zone of disseminated to net-textured nickel bearing sulphide mineralization located 20 to 80 metres below the hanging wall contact between the GUC and enclosing felsic/mafic volcanic rocks. Mineralogy is dominated by pyrrhotite, pentlandite and pyrite with lesser chalcopyrite. Rare occurrences of millerite, gersdorffite and other nickel bearing phases have been observed in and around late cross-cutting structural zones or in the footwall beneath the H3 Zone and are locally observed to contain strongly elevated PGE and gold values. There is some evidence for local gold enrichment around these structures as well.

Massive sulphide accumulations are, to date, limited to relatively narrow, short strike length lenses within the broader H3 Zone. These massive sulphide occurrences are characterized by extremely high nickel values – on the order of 12 to 19% Ni – which is the clearest demonstration of the high nickel “tenor” of the pentlandite mineralization within the H3 Zone. Tenor being crudely the amount of nickel (vs. iron) contained within the nickel bearing sulphide pentlandite. Drilling in late 2015 intersected a possible feeder type zone of high-grade, semi-massive, nickel sulphide mineralization in the immediate footwall to the H3 Zone at a depth of approximately 460 vertical metres.

A second zone of Ni-Cu-PGE sulphide mineralization, which runs sub-parallel to the H3 Zone occurs at the base of GUC in the area tested to date. This mineralized zone – H1 – has been traced for over 1,000 metres along strike and to vertical depth of approximately 350 metres. It remains open to the northwest and to depth. The H1 Zone is typically characterized by lower grades and lower nickel tenor values than the H3 Zone and remains to be fully evaluated.